Corporate Governance

- Basic approach

- Corporate governance system

- Complying with the Corporate Governance Code

- Dialogue with shareholders and investors

Basic approach

Enhancement of corporate governance through continuous reform is one of the pillars of our sustainability management. We will continue to continuously reform and verify management resources and risk management, and build and maintain effective corporate governance. In addition, we will flexibly adapt to changes in the business environment and strive for resilient corporate management that contributes to the sustainable growth of the Group.

The Board of Directors of artience Co., Ltd. (hereinafter referred to as the “Company”) has established the following basic corporate governance policies to contribute to the sustained growth of the Company and its subsidiaries and affiliates (hereinafter referred to as the “Group” collectively) and the improvement of their corporate values in the medium and long term.

Chapter 1 General Provisions

Article 1: Basic Ideas Concerning Corporate Governance

The Company shall continue to improve corporate governance based on the following approaches from the perspectives of sustaining the growth of the Group and enhancing its value in the medium and long term.

- Respect the rights of shareholders and make efforts to guarantee their substantial equality.

- Attempt appropriate collaborations with various stakeholders.

- Guarantee transparency by disclosing corporate information (including nonfinancial information) appropriately.

- The Board of Directors acknowledges its fiduciary responsibility to shareholders, and works to maintain and improve its functions.

- Hold constructive dialogues with shareholders that have investment policies in agreement with medium- and long-term shareholder returns.

Chapter 2: Guarantee of the Rights and Equality of Shareholders

Article 2: General Meetings of Shareholders

The Company shall issue the convocation notice for an Ordinary General Meeting of Shareholders at least three (3) weeks before the date of the Meeting so that shareholders can sufficiently examine the items on the agenda of the Meeting and exercise their voting rights appropriately. At the same time, the Company shall disclose the relevant convocation notice through the Timely Disclosure Network (TDnet) of the Tokyo Stock Exchange and on its official website.

2 The Company shall make efforts to prepare conditions for the exercise of voting rights by shareholders, including the practical use of a platform for the electronic exercise of voting rights and translation into English of the reference material for the notice of the annual general meeting of shareholders.

Article 3: Guarantee of the Rights and Equality of Shareholders

The Company shall attempt to make appropriate responses for substantially guaranteeing the rights of shareholders and work to prepare conditions for the exercise of their rights. In addition, the Company shall give consideration to the substantial equality of shareholders, including minority shareholders and foreign shareholders.

Article 4: Shareholdings Based on Policies

As part of its management strategy, including business alliances, maintaining and strengthening business relationships, and stable procurement of raw materials, the Company shall hold shares in companies that it deems necessary, as a matter of policy. Every year, the Board of Directors shall examine the economic rationality of each individual shareholding from a medium- to long-term perspective, and sell those shares that have lost their significance as shareholdings.

2 As a result of the verification set forth in the preceding paragraph, even if it is determined that there is significance in holding a stock, if it will contribute to improving the capital efficiency of the Group, we will proceed with the sale after carefully discussing with the issuer.

3 The Company shall exercise voting rights based on the listed shares held on the basis of its policies appropriately for each agenda item, taking into consideration points such as whether or not the agenda item concerned will contribute to enhancing the value of issuing companies in the medium and long term, whether or not the agenda item concerned will contribute to the common interests of shareholders, including the Company, and how the agenda item concerned will affect the management and businesses of the Group, both qualitatively and comprehensively. Where an issuing company has special circumstances, such as the occurrence of significant damage to its corporate value or a serious compliance violation, or where there is a concern that an issuing company may damage the corporate value of the Company as its shareholder, judgment over whether or not to approve shall be made carefully by collecting sufficient information through dialogues with the issuing company or by other means.

Article 5: Capital Policies

The Company shall calculate the capital cost accurately and disclose management targets, such as the overseas sales ratio, the operating margin, the return on equity (ROE,) the balance of interest-bearing debt etc., in its business plans. At the same time, the Company shall implement financial strategies for their achievement, giving consideration to the balance of operating, investing and financing cash flows. In so doing, as its capital policies, the Company shall aim to enhance shareholder value in a sustained manner and realize flexible responses to business opportunities. At the same time, the Company shall adopt the basic policy of keeping an equity capital level to prepare sufficiently for sudden changes in economic conditions and the like.

Regarding shareholder returns, the Company shall attach importance to the continuation of stable dividends while working to secure business foundations that are sustainable on a long-term basis. Regarding capital policies that may cause changes in the hierarchy or large-scale dilution, the Company shall ask the Board of Directors to discuss their rationality and provide sufficient explanations to stakeholders, including shareholders and investors.

Regarding shareholder returns, we will place emphasis on continuing stable dividends while striving to ensure a long-term sustainable management base. Regarding capital policies that result in changes in control or large-scale dilution, the board Board of Directors will deliberate on their rationality and provide sufficient explanations to shareholders, investors, and other stakeholders.

Article 6: Related Party Transactions

The Company shall conduct all transactions, including transactions with related parties, in accordance with internal regulations and after obtaining the necessary approvals. In addition, Board of Directors will monitor transactions with related parties to ensure that they do not harm the interests of the Group and the common interests of shareholders.

Chapter 3: Appropriate Collaboration with Stakeholders

Article 7: Rules for Corporate Behavior

The Company shall establish “artience Group Philosophy System,” which outlines the ideal image that the Group should aim for, and the basic ideas and actions required of the Group’s officers and employees, and “artience Group Code of Ethical Conduct,” which lays out the rules that all officers and employees should comply with as members of the Group, and the Board of Directors shall regularly review the status of their implementation.

Article 8: Relationships with Stakeholders

In accordance with the artience Group Philosophy System and the artience Group Code of Ethical Conduct set forth in the preceding article, the Company shall provide safety, security, and satisfaction to business partners, customers, consumers, and others throughout the supply chain, respect the rights and diversity of all employees involved in the Group’s business activities, contribute to the preservation and restoration of the global environment, and contribute to the improvement of social sustainability through all corporate activities. The Company will work to improve shareholder satisfaction through information disclosure and constructive dialogue, and aim to increase the corporate value of the Group.

Article 9: Sustainability

The Company shall establish an appropriate system for the promotion and execution of sustainability-related issues, including a Sustainability Committee, and the Board of Directors shall review the status of its implementation.

2. The Company shall identify and evaluate social issues that are important to the Group and for which there is high social demand as material issues, and shall actively / proactively disclose the details of these issues and the results and outcomes of corresponding measures.

Article 10: Ensuring Diversity

The Company shall work to ensure the diversity of its employees, create a workplace that draws out diverse values, and encourages the active participation of female employees, based on the recognition that learning from each other through diverse values, thinking, and ideas — and the synergistic effects thereof — is a source of sustainable growth for the Company itself.

Article 11: The Whistle-Blowing System

Sections within the Company or external offices shall promptly submit reports on directors or operating officers that they receive on the basis of the Company’s whistle-blowing system to the Audit & Supervisory Committee.

2 The Company shall protect individuals who submit reports based on the whistle-blowing system stated in the preceding paragraph in accordance with the company regulations on whistle-blowing.

Chapter 4: Corporate Governance Structure

Article 12: Roles of the Board of Directors

The Board of Directors shall make decisions on important management matters, including the basic policies and strategic direction of the Group, and shall create an environment for the execution of duties by Directors and Operating Officers, and engage in highly effective supervision. The Board of Directors will also work to improve the level of the internal control system, which will lead to an increase in corporate value.

2 Directors shall evaluate the effectiveness of the Board of Directors once a year. In addition, Directors shall ask a third party to evaluate the Board of Directors as required.

Article 13: Composition of the Board of Directors

The Board of Directors shall consist of an appropriate number of people within the number prescribed in the Articles of Incorporation, taking diversity and expertise into consideration. At least one-third (1/3) of the Board shall be Independent Outside Directors who conform to the standard for independence established separately by the Company.

Article 14: Composition of the Audit & Supervisory Committee

The Audit & Supervisory Committee shall consist of a number of people required to guarantee the effectiveness of audits within the number prescribed in the Articles of Incorporation. At least majority of the outside Audit & Supervisory Committee Members shall conform to the standard for independence established separately by the Company. At least one (1) individual with an appropriate knowledge of finance and accounting shall be appointed as an Audit & Supervisory Committee Member.

Article 15: Advisory Committee

The Company shall establish a voluntary Advisory Committee, chaired by an Outside Director. The Advisory Committee shall be available to the Board of Directors for consultation regarding the process of nominating Directors and other details such as executive remuneration, and shall discuss the appropriate course of action.

Article 16: Training

The Company shall provide the training and information required by Directors to perform their roles and functions appropriately.

Chapter 5: Dialogues with Shareholders

Article 17: Dialogues with Shareholders

The Company shall engage in sincere dialogue with shareholders to achieve sustainable growth and increase corporate value, from a medium- to long-term perspective.

2 To encourage constructive dialogue, the Company shall establish the following systems and initiatives.

- Designate a director in charge of IR to oversee IR activities.

- Establish a department in charge of general shareholders and a department in charge of investors, which will serve as external points of contact and seek to enhance dialogue in cooperation with other relevant Group departments.

- Hold briefings for investors, in addition to individual meetings, as a means of dialogue to promote understanding of the Company’s management policy, business performance, and business operations, etc.

- Share the content of dialogue among officers by periodically reporting to the Board of Directors and other means.

- Disclose information fairly and proactively, in accordance with the Disclosure Policy (Policy on Information Disclosure.) Give consideration to the management of insider information, such as setting a silent period for dialogue.

Chapter 6: Other Provisions

Article 18: Supplementary Provisions

The Board of Directors may revise or abolish these Basic Policies.

Established on November 9, 2015

Partially revised on December 14, 2018

Partially revised on November 12, 2021

Partially revised on March 23, 2022

Partially revised on January 1, 2024 (Resolved on December 8, 2023 at Board of Directors)

Partially revised on August 9, 2024

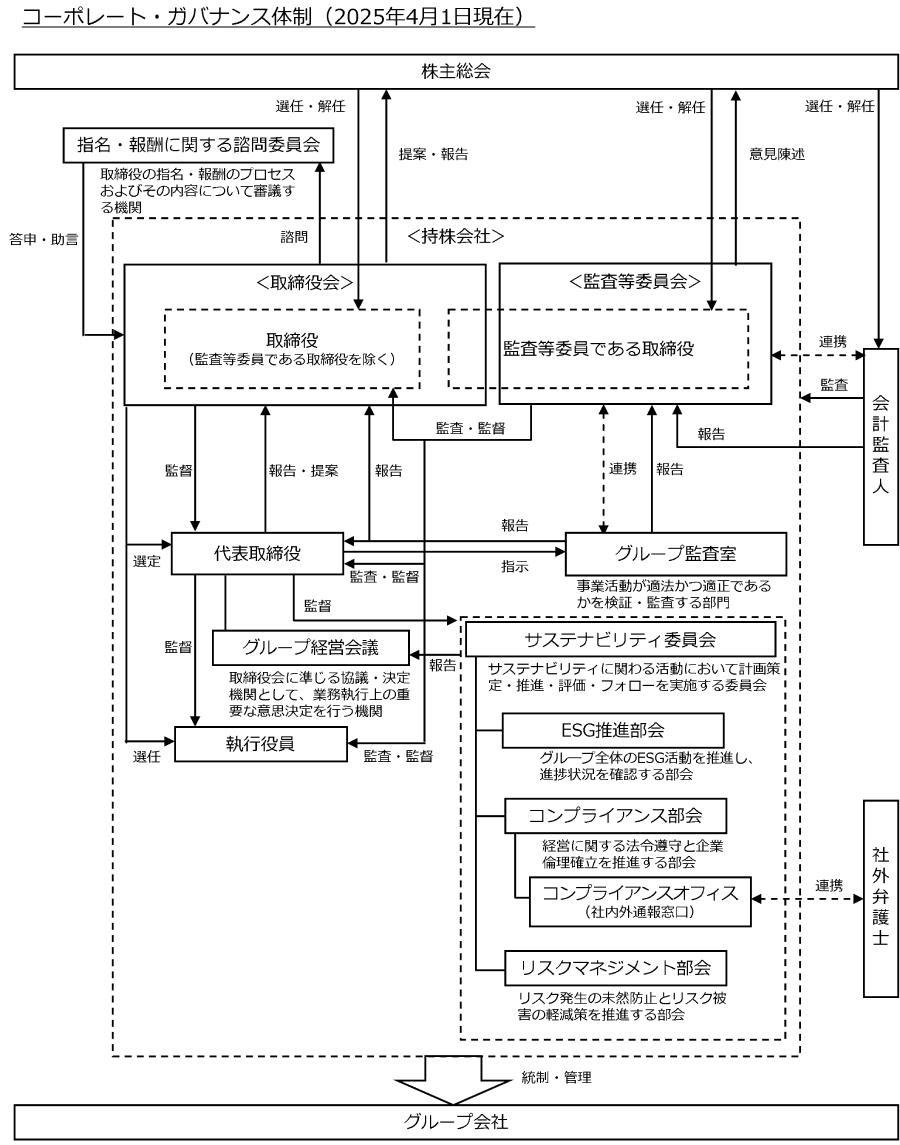

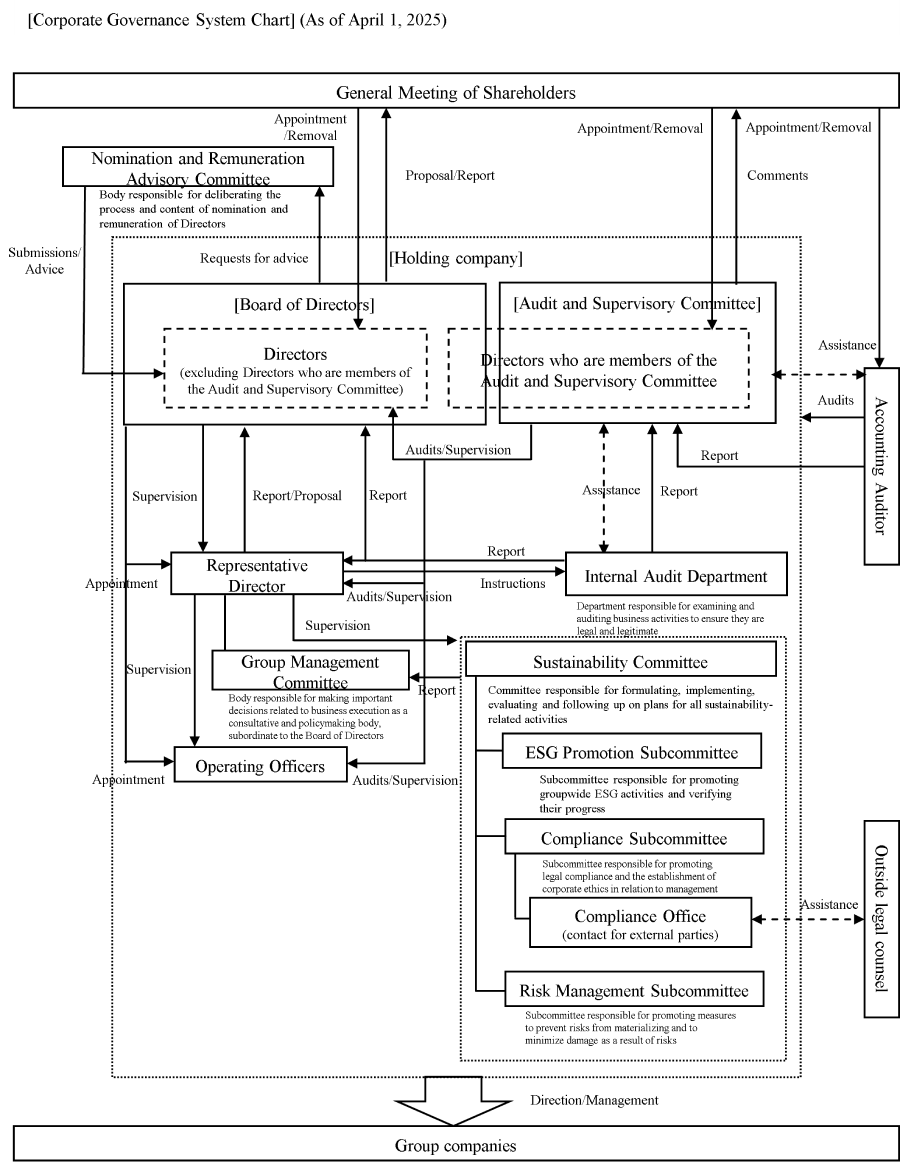

Corporate governance system

Corporate Governance System (FY2025)

Main organization/meeting structure and roles

| Main organization/meeting system | Structure | role |

|---|---|---|

| Board of Directors FY2024 Number of events: 17 Term of office: 1 year |

Chairperson: President and Representative Director Members: 11 members (including 3 women), including Director 7 (including Outside Director 4 members) who are not members of the Audit and Supervisory Committee and Director 4 members (including Outside Director 3 members) who are members of the Audit and Supervisory Committee |

It is held once a month as an important decision-making body for the management of the entire group, and also holds extraordinary meetings as necessary to decide on matters stipulated by law and important management matters, and to review the status of business execution. I am supervising. |

| Audit and Supervisory Committee FY2024 Number of events: 13 Term: 2 years |

Members: 4 Audit & Supervisory Committee members (including Outside Director 3) | In cooperation with the Group Internal Audit Office and Accounting Auditors, which are internal audit departments, we audit the legality and appropriateness of the execution of Director 's duties. In addition to regular Audit and Supervisory Committee reports, information exchange meetings are held with the Group Audit Office, which is the internal audit department. In addition to reporting audit results with Accounting Auditors, we also hold information exchange meetings from time to time. |

| Group Management Committee FY2024 Number of events: 26 |

Members: Internal Director, full-time Audit and Supervisory Committee members, Operating Officers who supervise or are in charge of important management functions, and presidents of core operating companies | Group Management Committee is a consultative and decision-making body in accordance with the Board of Directors and makes important decisions on the execution of business. In addition, since the Group Management Committee mainly discusses the Group's business strategy and business execution issues and performance, the Operating Officers, Finance & Accounting Department and Human Resources Department managers in charge of technology, research, development, and intellectual property who do not attend the Board of Directors are TOYOCOLOR Co., Ltd., TOYOCHEM Co., Ltd., and TOYO INK Co., Ltd. Director are always present. |

| Nomination and Remuneration Advisory Board FY2024 Number of events: 4 |

Chairperson: Outside Director |

Director Discusses candidates and their compensation. The committee, which is majority-headed by Outside Director, advises Board of Directors on the appointment and remuneration of officers, thereby further enhancing transparency and objectivity in the process of determining the nomination and remuneration of Director and its contents. |

Composition and activities of the main meetings of the Director (as of March 26, 2025)

◎: Chairperson/Chairperson ◯: Members

| Composition of the meeting body and attendance status in FY2024 | ||||

|---|---|---|---|---|

| position | Name | Board of Directors | Audit and Supervisory Committee | Advisory Committee on Appointment and Remuneration |

| President and Representative Director Group CEO |

Satoru Takashima | ◎ (17/17) |

― | ○ (4 /4) |

| Director Vice President In charge of general management and corporate divisions |

Hiroyuki Hamada | ○ (17/17) |

― | ― |

| Independent Outside Director | Tomoko Adachi | ○ (17/17) |

― | ― |

| Independent Outside Director | Yoshinobu Fujimoto | ○ (12/13) * 1 |

― | ― |

| Independent Outside Director | Yukihiro Tachihuji | ○ * 2 | ― | ○ * 2 |

| Independent Outside Director | Noriko Kosugi | ○ * 2 | ― | ― |

| Director In charge of quality assurance, production, environment, sustainability, purchasing, and logistics |

Tetsuaki Sato | ○ (17/17) |

― | ― |

| Director, Audit and Supervisory Committee member (full-time) | Masayuki Kano | ○ (13/13) * 1 |

◎ (10/10) * 1 |

― |

| Leading Independent Outside Director | Yutaka Yokoi | ○ (17/17) |

○ (13/13) |

◎ (4/4) |

| Independent Outside Director | Keiko Kimura | ○ (17/17) |

○ (13/13) |

○ (4 /4) |

| Independent Outside Director | Minoru Matsumoto | ○ (17/17) |

○ (13/13) |

― |

* 1 Inaugurated March 26, 2024

* 2 Inaugurated March 26, 2025

List of officers (reasons for selection/skill matrix)

Standards Concerning the Independence of Outside Officers

Complying with the Corporate Governance Code

Evaluation of the effectiveness of Board of Directors

Every year, the Company conducts an evaluation of the effectiveness of the Board of Directors of all Director, including outside officers, and works to improve the Board of Directors based on the issues identified.

Issues identified in the past two years and initiatives implemented

Initiatives to address issues in the FY2022 Effectiveness Evaluation

- Based on the opinion that the reporting on dialogue with shareholders and investors is insufficient, we have decided to report to Board of Directors every six months from FY2023 onward.

- Based on the opinion that the details of officer training, including executive training, were unknown, we reported the annual implementation items to Board of Directors.

- In response to the opinion that the reporting from the Advisory Committee on Appointment and Remuneration to the Board of Directors is insufficient, we have increased the number of meetings of the Advisory Committee from FY2024 to deepen the discussion, and strengthened the reporting to the Board of Directors.

Initiatives to address issues in the FY2023 Effectiveness Evaluation

Based on the opinion that the composition of the Board of Directors should be made up of more people with business experience, two new candidates with high knowledge of management and finance were selected as Outside Director candidates at the 187th Regular General Shareholders’ Meeting to be held in March 2025.

FY2024 Effectiveness Evaluation Process (December 2024 ~ February 2025)

- With the involvement and advice of a third-party external organization, we created and implemented a questionnaire.

- Based on the results of a questionnaire conducted by an external organization, interviews were conducted with the chairperson and Independent Outside Director.

- The results of the questionnaire and interviews were analyzed, discussed, and evaluated in Board of Directors in March 2025.

FY2024 Effectiveness Assessment Results and Issues

- Generally positive evaluations were obtained, such as the effectiveness of Board of Directors is improving year by year, and it was recognized that the effectiveness of the Board of Directors as a whole has been ensured overall.

- Improvements were also confirmed in the items pointed out in the effectiveness evaluation in previous years.

- In the FY2024 Effectiveness Evaluation, there were proposals and suggestions for operational improvements to enhance discussions in Board of Directors and other areas, such as clarifying issues according to the expected role of the Director and enhancing the provision of information from the executive side. In response to this point, in order to create an environment for useful discussions, we have decided to work on enhancing opportunities for the exchange of opinions among Director and enhancing information sharing on Outside Director in FY2025.

Our Board of Directors will respond to the issues identified in this evaluation and grasp the status of improvement in the evaluation from the following fiscal year onward, and strive to continuously improve its effectiveness.

Executive compensation system

The Company recognizes the executive compensation system as an important matter in corporate governance, and has established the system based on the following basic policy, and operates the system while incorporating an objective perspective through Advisory Committee on Appointment and Remuneration Masu.

- The level must be in consideration of the balance with economic conditions and business results.

- Must be at a level that allows us to secure excellent managers to increase corporate value.

- A remuneration system that embodies the management philosophy and reflects the medium- to long-term management strategy, and strongly motivates sustainable growth.

- Incorporate a system that reflects performance linkage and motivates the achievement of public performance.

- Designed with fairness and rationality from the perspective of accountability to stakeholders, and decisions made through an appropriate process with increased objectivity and transparency.

Decision process for executive compensation system

Director The policy for determining the details of remuneration for each individual (excluding Director, who is a member of the Audit and Supervisory Committee) is decided by Board of Directors after deliberation by the Advisory Committee on Appointment and Remuneration, chaired by Outside Director.

Overview of executive compensation

From the perspective of focusing on Director Outside Director ensuring transparency, our company's Director remuneration consists of "basic remuneration," "performance-based remuneration," and "restricted stock remuneration." It consists of "rewards". The total remuneration for Director (excluding Director who are members of the Audit and Supervisory Committee), as resolved at the Ordinary General General Shareholders’ Meeting held on March 23, 2022, shall be no more than 500 million yen per year (including no more than 100 million yen Outside Director), and no more than 100 million yen for outside directors. The total remuneration for a certain Director is less than 100 million yen per year. Additionally, the total amount of monetary remuneration claims to be paid as restricted stock compensation to Director (excluding Director who are audit and supervisory committee members and Outside Director) is set at 100 million yen or less per year, in addition to the 500 million yen per year limit. .

- Basic remuneration is a monthly fixed remuneration in cash and is determined based on position.

- Performance-linked remuneration incorporates a system that reflects the evaluation of consolidated performance, and is paid as short-term incentive remuneration as monthly remuneration. This allowance is provided to internal Director who are not members of the Audit and Supervisory Committee.

- Restricted stock compensation is intended to share the benefits and risks of stock price fluctuations with shareholders, and to further increase motivation and contribution to improving the company's medium- to long-term performance and increasing corporate value by demonstrating a healthy entrepreneurial spirit. This is long-term incentive remuneration for internal Director who are not Audit and Supervisory Committee members.

The proportions of each compensation component (standard amount when performance-based compensation targets are achieved 100%) are designed to be 65% base compensation, 35% performance-based compensation, and 5% restricted stock compensation.

Director who are members of the Audit and Supervisory Committee receive only basic remuneration, with an upper limit of 100 million yen per year, in consideration of their responsibilities and roles in supervising and auditing the execution of business.

Director and remuneration for Audit & Supervisory Board Members (FY2024)

| Officer classification | Total amount of remuneration, etc. (One million yen) |

Total amount of compensation by type (million yen) | Number of eligible officers (given name) |

||

|---|---|---|---|---|---|

| fixed remuneration (basic remuneration) |

variable compensation (performance-based compensation) |

With transfer restrictions stock compensation |

|||

| Director (excluding Director who are audit and supervisory committee members) (including Outside Director) |

300 (37) |

203 (37) |

86 (-) |

10 (-) |

8 (4) |

| Director (Audit and Supervisory Committee Member) (including Outside Director) |

56 (30) |

56 (30) |

- | - | 5 (3) |

| sum (Outside Director of which ) |

356 (68) |

259 (68) |

86 (-) |

10 (-) |

Total 13 (Total 7) |

* The above amounts include one Director who retired at the end of the General Shareholders’ Meeting on March 26, 2024.

Thoughts on cross-shareholdings

Every year, we examine the economic rationality of cross-shareholdings in Board of Directors. We will examine the benefits of holding the stock compared to the cost of capital and the transaction status of each individual stock, and if we determine that the holding of the stock is not appropriate, we will proceed with the reduction of the number of stocks after taking into account the situation of the company concerned and market trends.

In addition, even if we do not judge that the significance of holding individual stocks has diminished, if they contribute to improving the capital efficiency of the Group as a whole, we will consider reducing them as appropriate and proceed with the sale after careful dialogue with the issuing company, thereby further reducing the number of shares held.

With regard to the exercise of voting rights for cross-shareholdings, the Company shall exercise voting rights appropriately for each proposal, taking into account qualitative and comprehensive considerations such as whether each proposal contributes to the medium- to long-term enhancement of the corporate value of the issuing company, whether it contributes to the common interests of shareholders including the Company, and the impact on the management and business of the Group. In addition, if there are special circumstances such as significant damage to corporate value or serious compliance violations at the issuing company, or if there is a concern that the corporate value of the Company as a shareholder will be impaired, the Company will carefully decide whether to approve or reject the proposal after gathering sufficient information through dialogue with the issuing company.

Investment stocks held for purposes other than pure investment purposes

| Number of brands (Brand) |

of the amount recorded on the balance sheet Total amount (million yen) |

|

|---|---|---|

| Unlisted stocks | 48 | 968 |

| Stocks other than unlisted stocks | 35 | 15,762 |

Information on the number of shares for each issue of specified investment stocks and deemed shareholdings, the amount recorded on the balance sheet, etc.

| Brand name | Current fiscal year | Previous business year | Purpose of holding, outline of business alliances, quantitative holding effect, and reason for the increase in the number of shares | Whether or not you own shares of our company |

|---|---|---|---|---|

| Number of shares (shares) | Number of shares (shares) | |||

| Amount recorded on balance sheet (million yen) | Amount recorded on balance sheet (million yen) | |||

| NIPPON SHOKUBAI CO., LTD.(Note 1) | 3,618,188 | 904,547 | We hold this property for the purpose of stable procurement of raw materials. | Yes |

| 6,928 | 4,915 | |||

| Toyo Seikan Group Holdings, Ltd. | 1,598,969 | 3,798,969 | We are engaged in transactions in polymer coatings related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Yes |

| 3,847 | 8,688 | |||

| Kyodo Printing Co., Ltd. | 216,920 | 216,920 | We are engaged in transactions in package-related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Nothing |

| 874 | 700 | |||

| Nissha Co., Ltd. | 435,000 | 457,894 | We are engaged in transactions in package-related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Yes |

| 709 | 674 | |||

| Marubeni Corporation | 266,851 | 266,851 | We hold this property for the purpose of stable procurement of raw materials. | Nothing (Note 2) |

| 638 | 594 | |||

| OSAKA ORGANIC CHEMICAL INDUSTRY LTD. | 174,000 | 175,000 | We hold this property for the purpose of stable procurement of raw materials. | Yes |

| 503 | 474 | |||

| ARAKAWA CHEMICAL INDUSTRIES, LTD. | 293,760 | 293,760 | We hold this property for the purpose of stable procurement of raw materials. | Yes |

| 324 | 297 | |||

| LINTEC Corporation | 100,000 | 100,000 | We are engaged in transactions in polymer coatings related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Nothing |

| 306 | 275 | |||

| TOMOKU CO., LTD. | 108,033 | 108,033 | We are engaged in transactions in package-related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Yes |

| 250 | 232 | |||

| KOMORI CORPORATION | 139,000 | 139,000 | We are engaged in transactions in printing and information-related businesses, and we hold them for the purpose of maintaining and strengthening business relationships. | Yes |

| 167 | 158 |

Note 1:NIPPON SHOKUBAI CO., LTD. has undergone a stock split at a ratio of four shares per common stock as of April 1, 2024.

Note 2: The company holding the shares does not hold the Company's shares, but the Company's subsidiary holds the Company's shares.

Dialogue with shareholders and investors

The Company considers shareholders and investors to be important stakeholders, and in addition to disclosing information in a timely and appropriate manner, the Company engages in sincere dialogue with shareholders and investors in order to achieve sustainable growth and increase corporate value, and utilizes the valuable opinions it receives to improve management.

The basic policy and the establishment of systems and initiatives to promote constructive dialogue are clearly stated in the "Basic Policy on Corporate Governance" (Article 17, Dialogue with Shareholders), and we will continue to implement them based on this policy.

Information disclosure is carried out proactively and fairly in accordance with the Information Disclosure Policy.

Details of IR and SR Activities (FY2024)

The main IR and SR activities in FY2024 (fiscal year ended December 2024) are as follows.

Primary responders

Group CEO, Director in charge of Corporate Division, Operating Officer in charge of investor relations, Officers in charge of business, Department in charge of Investor Relations, Department in charge of ESG, SR Department in charge of SR, etc.

Summary of shareholders and investors engaged in dialogue

Domestic and Overseas Institutional Investors, Securities Analysts, Individual Investors

Main activities

| activity | number of times | details |

|---|---|---|

| Financial results briefings for analysts and institutional investors, business briefings | 4 times |

|

| Individual interviews with domestic and overseas institutional investors, proxy voting officers, and analysts | Approximately 150 times in total | Individual interviews were conducted on a visit, in the office, and online (WEB or telephone). |

| Briefing session for individual investors | 2 times | Briefings were held and presentation materials were posted on the website for individual investors. |

| General Shareholders’ Meeting | 1 time | Conducted hybrid participatory virtual General Shareholders’ Meeting. |

| Disseminating information on the website | suitability | Financial results, financial results briefing materials, General Shareholders’ Meeting-related materials, video distribution and transcriptions, annual securities reports, quarterly reports, integrated reports, shareholder newsletters (to shareholders), timely disclosure materials, etc. Sponsored Research Reports (4 times a year, Japanese and English) |

Key themes and interests of the dialogue

- Financial Results and Future Outlook

- Medium-Term Management Plan artience 2027 Strategy and Progress

- Initiatives for management that is conscious of the cost of capital and stock price, especially to improve ROE and PBR

- Capital Policy, Cash Allocation, and Shareholder Returns

- Disclosure of Responses to Climate Change

- Board of Directors and Advisory Committee on Appointment and Remuneration configuration and activity

- Risk Management for Overseas Group Companies

- Voting Decisions on the Exercise of Voting Rights at Regular General Shareholders’ Meeting

Implementation of feedback to management and Board of Directors

- The Director in charge of corporate divisions reported on the opinions and dialogues of institutional investors and analysts on Board of Directors. Share information, discuss and provide feedback with Director and Outside Director. (Semi-annually)

- Quarterly reporting of dialogue to management and related departments.

- Reporting on the contents and results of individual investor briefings (on a case-by-case basis)

Matters incorporated based on dialogue and feedback

- Medium-Term Management Plan artience 2027 Partial Revision of Capital Policy and Update of Plan

- Reduction of shareholdings and implementation of additional shareholder returns

- Holding factory tours for institutional investors

- Enhancement of financial results briefing materials and supplementary financial results briefing materials

- Holding of business briefing on CNT dispersions for lithium-ion batteries

- Board of Directors configuration review

- Conduct regular SR interviews