Medium-Term Management Plan artience 2027 | Integrated Report 2024Financial Strategy

Published on June 28, 2024

This page has been translated using AI.

Takeshi Arimura

To financially support these actions and maximize capital efficiency and cash flow, we will use indicators such as as return on invested capital (ROIC,) free cash flow and cash conversion cycle (CCC.)

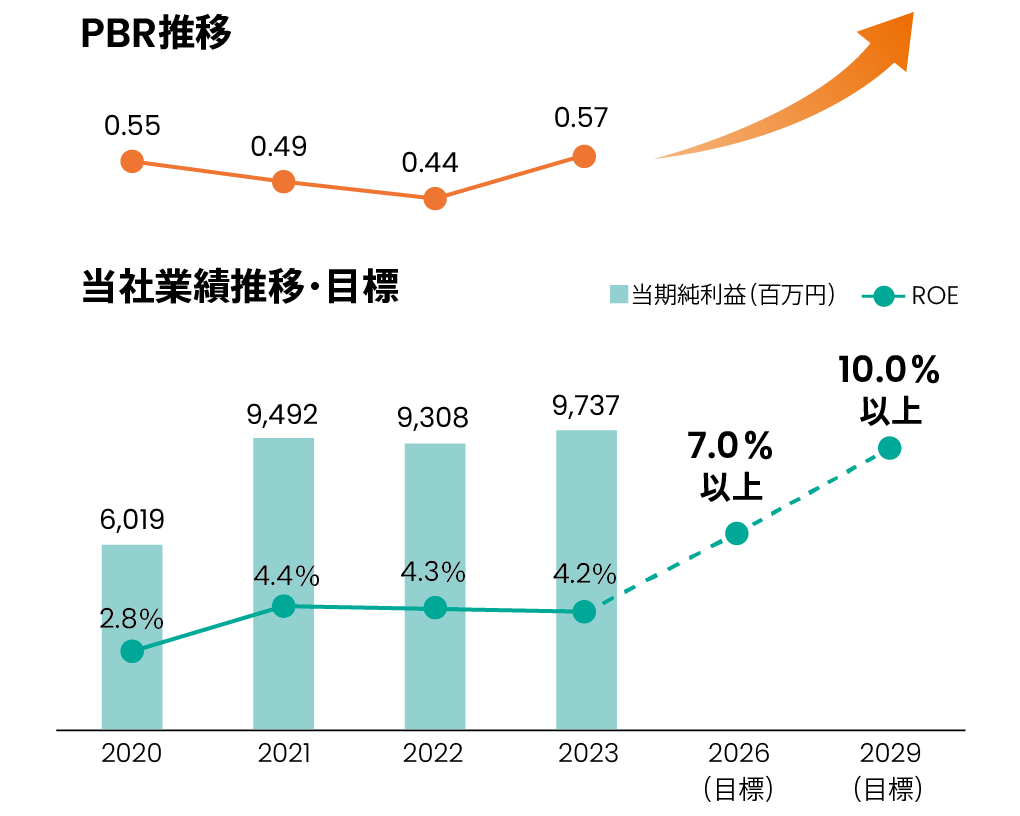

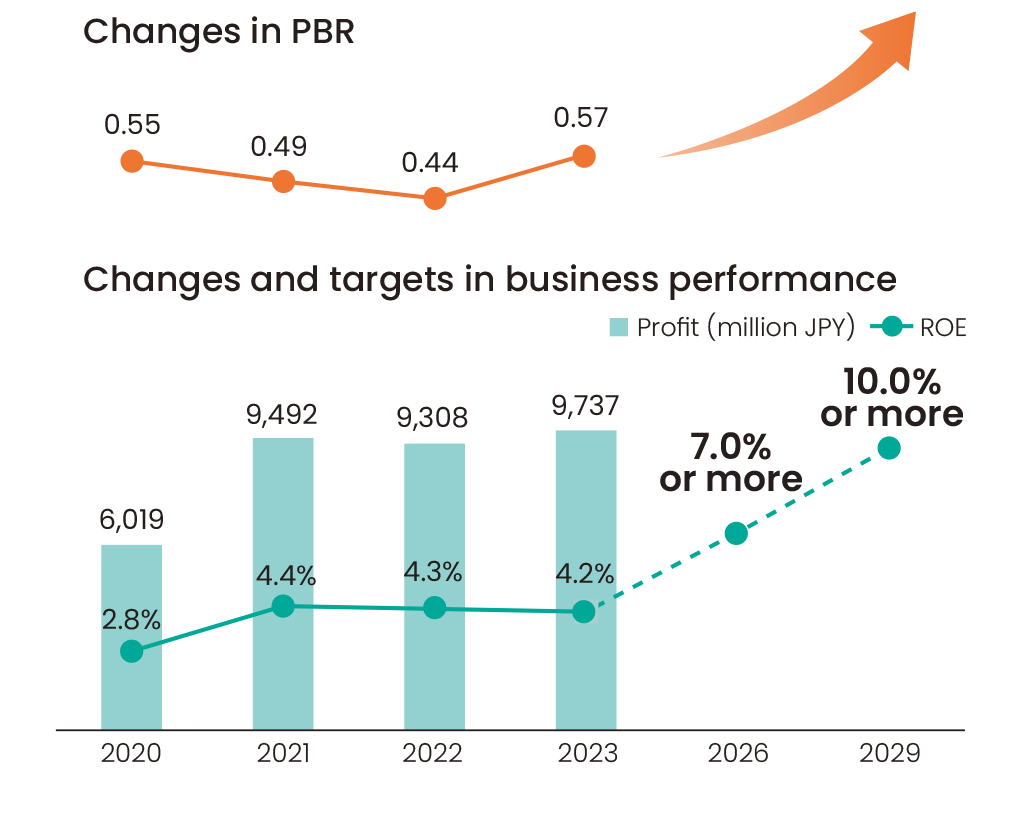

Financial achievements and issues during the previous medium-term management plan

During the period of the previous medium-term management plan, specifically from FY2021 to FY2023, the COVID-19 pandemic forced different plants to operate in difficult conditions. We also faced several issues including the difficulty of procuring raw materials resulting from chaos in the supply chain. We increased on-hand liquidity position by 20 billion yen. It was a necessary action to prepare for unexpected situations with a view toward maintaining inventories so that we would always fulfill our responsibilities as a manufacturer to supply product and avoid the nonpayment of our suppliers and employees. However, inventories stayed high even at the end of the previous fiscal year, even though the impact of the pandemic faded. This remains to be addressed.

On the other hand, we worked to improve our balance sheet. During the period of the previous plan, we sold 13.1 billion yen of stock that we held. Additionally, we repurchased more than 10.7 billion yen of treasury shares to start the efforts to reduce capital through shareholder return. In preparation for the future increase of interest rates, we increased our methods for procuring funds, such as the issuance of bonds and procurement from government-affiliated financial institutions.

To achieve a PBR of 1.0

|

Business portfolio transformation |

|

|---|---|

|

Increase capital efficiency |

|

|

Capital policies |

|

|

Efforts to lower capital costs |

|

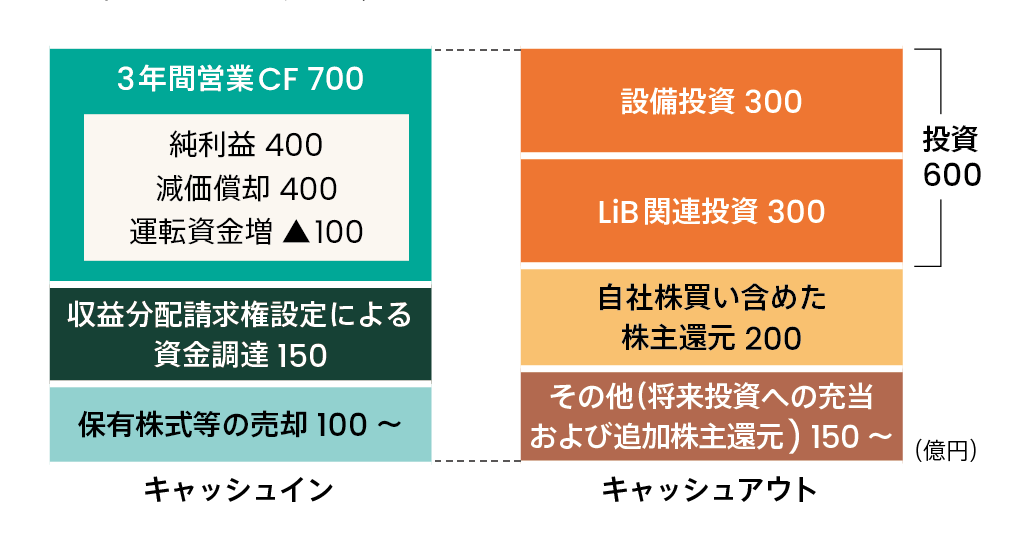

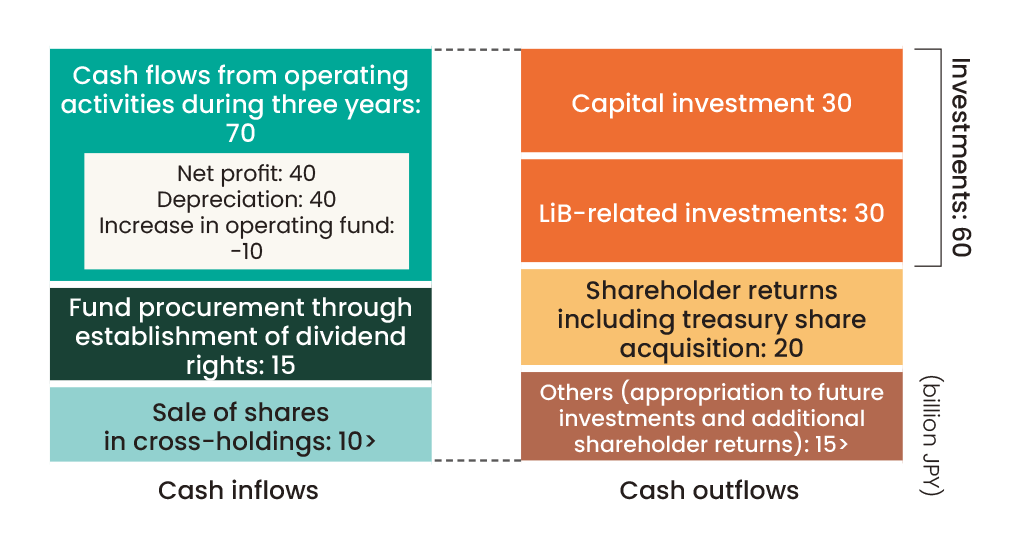

Actively investing in priority businesses while hedging risks

How to hedge the financial risks involved in the investment of 30 billion yen during the current medium-term management plan is a big question. Enjoying the support of the Development Bank of Japan, we managed to procure funds through a scheme under which we will repay the loans within the limit of the cash flows produced by the business. I believe that this will ensure the financial health of the whole Group even even if any business risks materialize. We will thus hedge risk while actively investing in priority businesses in an effort to maximize cash flows.

Cash allocation

Using ROIC to enhance capital efficiency

To maximize capital efficiency as stated in the medium-term management plan, we have begun using ROIC, free cash flow and other indicators to improve company-wide awareness of capital efficiency. In terms of investments, we will monitor the ROICs of individual businesses to use resources in an efficient way

Our activities to develop a solid awareness of efficiency within the Group as a whole are now under way. We have established a task force to facilitate the introduction of capital efficiency indicators and disseminate information about them. It began its activities to encourage the use of these indicators in business activities.

To manage free cash flow and the CCC, we have established yearly targets for them and we have started working to manage them on a monthly basis.

Balance sheet reform and shareholder return

During the previous medium-term management plan, we sold 13.1 billion yen of cross-holding shares as well as idle real estate and implemented shareholder re-turn activities with a total payout ratio of nearly 90% in the three-year period. Meanwhile, net assets increased due to a rise in the prices of cross-holding shares and a surge in the foreign currency translation adjustment. In the three-year period of the current medium-term management plan, we will move forward with the sale of at least 10 billion yen of cross-holding shares, aiming to reduce our assets.

The medium-term management plan includes a shareholder return policy with a total payout ratio of 50%. This means that we will return at least a half of the cash that we gain to shareholders and appropriate the remaining half to investments for growth.

Missions and roles of the General Manager of the Finance & Accounting Dept.

To increase corporate value in the medium and long term, it necessary for the business to grow. People inside the company and external stakeholders share this idea. However, people’s ideas regarding the time frames for acting, the balance between growth and returns and other matters are different depending on their perspective. We will present our policy in the medium-term management plan and engage in investor relations activities to explain the policy to people to enable them to understand it. Internally, we will develop budgets and goals that reflect the policy and control them. I understand that my roles are to build a system for ensuring this, to set targets and to manage the progress toward them.

My mission is to establish a virtuous cycle in which we maximize cash flows using ROIC, free cash flow, CCC and other indicators to increase capital efficiency and in which we will appropriate the cash flows to shareholder returns and to investments for our growth. To achieve the perpetual development of the company, it is also necessary to maintain a solid financial foundation. I think we definitely need to maintain A-ratings from financial rating agencies.

Management Plan artience2027/2030 "GROWTH"