Medium-Term Management Plan artience 2027 | Integrated Report 2024Business portfolio transformation

Published on June 28, 2024

This page has been translated using AI.

We will review our numerous businesses to prioritize them and concentrate our resources on high-priority businesses for the development of competitive businesses. With this business portfolio transformation, we seek to achieve continued growth.

Hiroyuki Hamada

Making strengths stronger

Characteristics of our business portfolio are that it includes a large number of products, stretches across a wide variety of sectors and broadly serves markets in Japan and overseas. We have developed technologies based on the colorants and polymers used in printing inks to supply a broad range of products from daily necessities to cutting-edge materials for many different markets. Our businesses do not depend on specific sectors. This provides an advantage in that risks are diversified but the drawback is that resources tend to be scattered.

The acceleration of digitalization means that the ongoing shrinkage of the information printing markets will continue. Color filter materials for liquid crystal displays used to be one of our major sources of revenue. The commoditization of final products resulted in prices falling. It is now difficult to the previous level of profitability from them.

In these business circumstances, we must depart from the stance of generally addressing all of our busi nesses, and increase operating profit back to the FY2016 level and higher. During the 2027 Medium-term Management Plan, we will clarify the areas we will focus on and concentrate our resources in these areas. We will make our strong businesses stronger. In so doing, we will transform our business portfolio and accelerate the growth of both existing and new businesses.

Shift to existing businesses with high profitability

Previously, we carried out structural reforms including the promotion of alliances, the integration of sales companies and the closedown and integration of production bases in unprofitable areas to achieve some positive results.

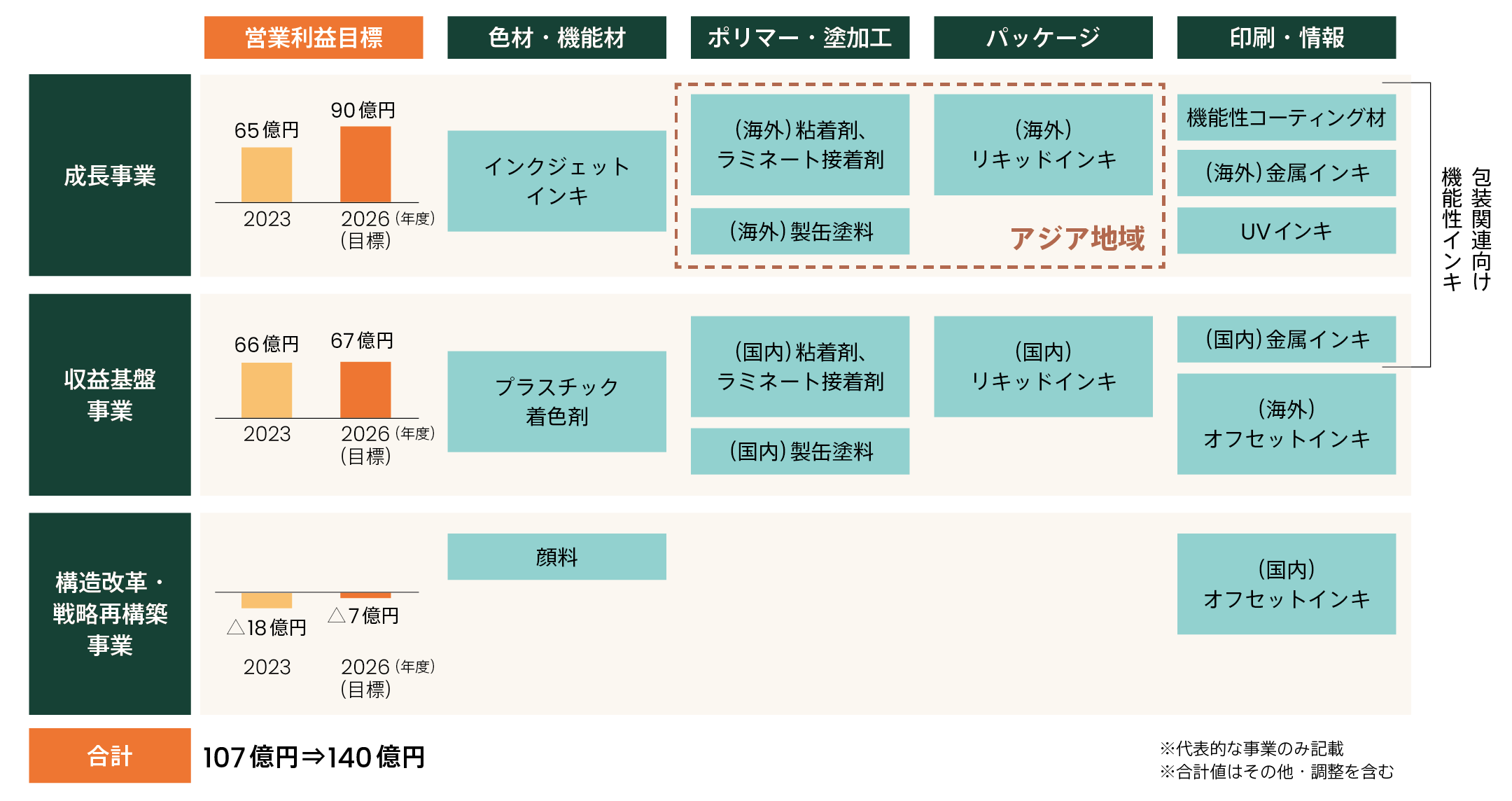

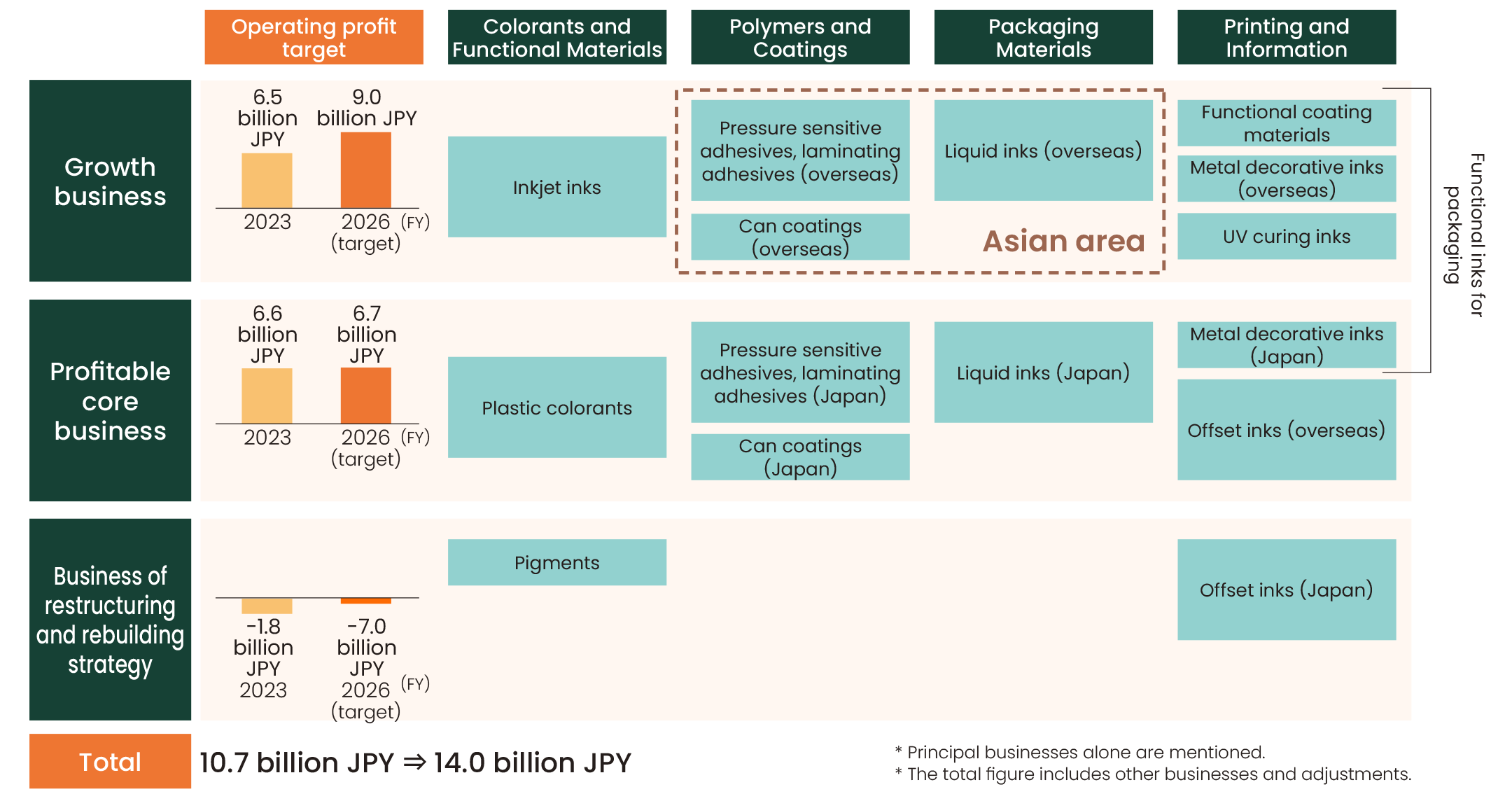

During the artience 2027 Medium-term Management Plan, we will take a proactive stance. We have divided our existing businesses into three groups, growth businesses, stable earnings base businesses and businesses where we will implement a restructuring and rebuilding strategy. We then determined our approaches for each of these groups. Acting uniformly is the same as intensively doing nothing. The idea behind Basic Policy 1 is to change the ways that we think more drastically and to make our strengths stronger.

Classification of the main existing businesses and operating profit targets

In the growth businesses group, we have set the goal of increasing operating profit from 6.5 billion yen in FY2023 to 9.0 billion yen in FY2026. We suspect there are more existing businesses in which we can seek greater profit. Instead of being satisfied with a certain level of profit, we will work thoroughly to avoid missing any opportunity.

The growth businesses deal mainly in packaging-related materials, including liquid inks, pressure sensitive adhesives and laminating adhesives. In Japan, we have a large share of the markets for all of these products. Since these markets are not expected grow significantly, they are not positioned as revenue foundation businesses. However, from a global perspective, there is great potential for these businesses to leap forward.

We will work very hard on our strong businesses in Southeast Asia, India, Turkey and other regions that have the potential for the growth of their populations in the future

Our liquid inks for packaging materials in Southeast Asia are strong in Thailand and Malaysia. In the future, we will put more energy into Indonesia as well. Its population is nearly 300 million. Among the companies in out Group, our India business has one of the leading growth rates, but I believe that there is still significant room to expand its market share. In Turkey, a new production base will begin operating in July 2024. According to our plan, we will increase the number of production bases and increase their capacity to increase sales not only in Turkey but also to Europe, the Middle East and Africa.

In markets that are expected to expand in the future, we will identify areas where we can leverage our business advantages. We will operate our businesses, not in a generalized manner but by placing clear emphasis on certain areas. We will develop our businesses outside of Japan into growth drivers, especially in the Asia region.

Currently, overseas net sales are approximately 54% of the Group’s total net sales. Our goal is to earn 60% to 70% of our net sales overseas.

Creation of strategic priority businesses

We determined three domains of strategic priority businesses from the perspective of growth potential of the markets and areas where our technologies can be utilized. During the medium-term management plan, we will focus on two domains. The one is Mobility and Battery Related Businesses and the other is Display and Advanced Electronics Related Businesses. We will invest intensively and on an unprecedented scale in these domains to develop them into future growth pillars.

Our CNT dispersions have been highly received and been selected by a series of major battery manufacturers. To seize this opportunity, we increased the funds in our investment plan from over 25 billion to more than 49 billion yen. (This is a cumulative total amount including the approximately 15 billion that has already been invested.)

We forecast that the net sales of the CNT dispersions business alone will be more than 20 billion yen in FY2025 and more than 40 billion yen in FY2026. Centering on this business, our business portfolio will change dramatically. The day may possibly come in the not-so-far future when artience will be an electric vehicle brand.

Our trust-based relationships with customers that we have established in our conventional businesses such as color filter materials and electromagnetic wave shield materials are a great advantage and asset to us. This is also true in the electronics sector. I believe that there are still latent business opportunities in the areas around the display and advanced electronics-related products that we have supplied. We will take advantage of our relationships with markets to broaden our horizons and capture needs for related materials in a bid to promote materials for next-generation displays and semiconductors.

artience as a revamped company

Management Plan artience2027/2030 "GROWTH"